Identity theft is a growing concern in today’s digital age, where cybercriminals can easily steal your identity. With more and more personal information being stored online, it has become easier for cybercriminals to steal identities and wreak havoc on people’s lives. Fortunately, there are several identity theft protection services available to help safeguard against this type of crime. In this article, we will review the top 5 identity theft protection services to help you choose the best option for your needs.

The best identity theft protection services offer a range of features, including credit monitoring, identity monitoring, and identity restoration services. These services can help detect fraudulent activity and alert you when suspicious activity is detected. They can also assist you in restoring your identity if it has been compromised. With so many options available, it can be difficult to choose the right service for you. That’s why we’ve done the research and compiled a list of the top 5 identity theft protection services to help make your decision easier.

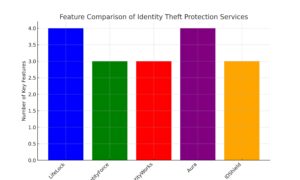

| Service Name | Credit Monitoring | Identity Restoration | Insurance Coverage | Additional Features |

|---|---|---|---|---|

| LifeLock | Yes (24/7) | Yes | Up to $1 million | VPN, Family Plan |

| IdentityForce | Daily | Yes | Up to $1 million | Mobile App, Limited Family Plan |

| Experian IdentityWorks | Daily | Yes | Up to $1 million | Dark Web Surveillance |

| Aura | Yes (24/7) | Yes | Up to $1 million | Innovative Technology, Family Plan |

| IDShield | Unlimited Access | Yes | Up to $1 million | Mobile App, Cost-effective Family Plan |

Understanding Identity Theft and Protection Services

Identity theft involves stealing personal information to commit fraud. Protection services monitor your data and alert you to suspicious activities. They offer tools like credit monitoring and help restore your identity if compromised, providing peace of mind in a digitally connected world.

What Is Identity Theft?

Identity theft is a crime in which someone steals personal information such as a name, social security number, driver’s license number, or credit card information to commit fraud or other crimes. It can happen to anyone, and the consequences can be devastating. Victims of identity theft may have their credit ruined, their bank accounts emptied, and their reputations tarnished.

How Identity Theft Protection Services Work

Identity theft protection services are designed to help prevent identity theft and minimize the damage if it does occur. These services typically offer monitoring, alerts, and protection. Monitoring involves keeping an eye on personal information such as credit reports, bank accounts, and social media accounts. If any suspicious activity is detected, the service will notify the individual. Alerts are notifications that are sent to the individual when there is a potential threat to their personal information. For example, if a credit card application is made in their name, the service will alert the individual so they can take action.

Protection involves taking steps to prevent identity theft from happening in the first place. This may include things like freezing credit reports, setting up two-factor authentication, and shredding sensitive documents. There are many identity theft protection services available, and they vary in terms of what they offer and how much they cost. It’s important to do research and choose a service that meets individual needs and budget. By using an identity theft protection service, individuals can have peace of mind knowing that their personal information is being monitored and protected. However, it’s important to remember that no service can guarantee 100% protection against identity theft.

Top Identity Theft Protection Services Reviewed

Identity theft is a growing concern in today’s digital world. With so much of our personal information online, it’s important to have a reliable identity theft protection service. Here are the top 5 identity theft protection services reviewed:

1. LifeLock: Comprehensive Coverage

LifeLock is a well-known identity theft protection service that offers comprehensive coverage. It provides 24/7 monitoring of your personal information, including credit reports and social security numbers. LifeLock also offers identity theft insurance up to $1 million and alerts you if there are any suspicious activities on your accounts. Additionally, it offers a VPN service to protect your online privacy and a family plan for multiple users.

2. IdentityForce UltraSecure+Credit: Best for Credit Monitoring

IdentityForce UltraSecure+Credit is a great option for those looking for credit monitoring services. It provides daily credit monitoring from all three credit bureaus and alerts for any changes to your credit score. IdentityForce also offers identity theft insurance up to $1 million and a mobile app for easy access to your account. However, its family plan is limited to two users.

3. Experian IdentityWorks: Direct from a Credit Bureau

Experian IdentityWorks is a direct-to-consumer service from one of the major credit bureaus. They offer daily monitoring of your credit report and alerts for any changes. Experian also provides identity theft insurance up to $1 million and a dark web surveillance feature. However, their family plan is limited to two adults and up to 10 children.

4. Aura: Innovative Technology Use

Aura is a newer identity theft protection service that uses innovative technology to protect your personal information. It offers 24/7 monitoring of your credit reports, social media, and the dark web. Aura also provides identity theft insurance up to $1 million and alerts for any suspicious activities on your accounts. It does not offer a VPN service, but its family plan includes up to four users.

5. IDShield: Affordable Family Plans

IDShield is a cost-effective option for those looking for a family plan. They offer unlimited access to your credit report and score, as well as alerts for any changes. IDShield also provides identity theft insurance up to $1 million and a mobile app for easy access to your account. However, their monitoring services are limited to one credit bureau.

Features and Benefits of Top Services

When it comes to identity theft protection services, the top providers offer a range of features and benefits to help keep your personal information safe. Here are some of the key features and benefits of the top five identity theft protection services reviewed:

Monitoring and Alerts

All of the top identity theft protection services offer monitoring and alerts to help you stay on top of any potential threats to your identity. , This includes monitoring your credit reports, social media accounts, and the dark web for any signs of suspicious activity. You’ll receive alerts if any unusual activity is detected so you can take action to protect yourself.

Identity Restoration and Insurance

If your identity is ever compromised, the top identity theft protection services offer identity restoration services to help you recover. This includes assistance with filing police reports, notifying credit bureaus, and disputing fraudulent charges. In addition, many of the top providers offer identity theft insurance to cover any losses you may incur as a result of identity theft.

Additional Protection Layers

In addition to monitoring and restoration services, many of the top identity theft protection services offer additional protection layers to keep your personal information safe. This includes VPN services to encrypt your internet connection, antivirus software to protect against malware, and stolen funds reimbursement to cover any losses you may incur if your funds are stolen.

Choosing the Right Service for Your Needs

Protecting yourself from identity theft is crucial in today’s digital age. With so many identity theft protection companies available, it can be challenging to choose the right one for your needs. Here are some factors to consider when selecting a service:

Comparing Service Plans

Different identity theft protection services offer various plans with different features. It is essential to compare these plans to find the one that best suits your needs. Some services may offer credit monitoring, while others may provide identity restoration services.

Evaluating Cost vs. Protection Level

The cost of identity theft protection services can vary widely. It is crucial to evaluate the cost of each service and compare it to the level of protection it provides. Some services offer more comprehensive protection but come at a higher cost. It is important to find a balance between cost and protection level.

Understanding Policy Terms

It is essential to read and understand the policy terms of any identity theft protection service you are considering. Some services may have coverage restrictions or not cover certain types of identity theft. Reading the policy terms can help you determine if the service is the right fit for your needs.

Video Guide

Frequently Asked Questions

What are the top-rated identity theft protection services, according to consumer reports?

Consumer Reports recommends a few identity theft protection services, including LifeLock, IdentityForce, and Identity Guard. These services offer features such as credit monitoring, identity theft alerts, and identity restoration services. Consumers should research each service to determine which one best meets their needs.

How do identity theft protection services differ for seniors?

Some identity theft protection services offer special features for seniors, such as credit report monitoring, fraud detection, and identity restoration services. These services may also offer educational resources to help seniors protect themselves from identity theft. Consumers should research each service to determine which one best meets their needs.

What are the pros and cons of investing in identity theft protection?

The pros of investing in identity theft protection include peace of mind, early detection of identity theft, and assistance with identity restoration. The cons include the cost of the service and the fact that identity theft protection cannot prevent all instances of identity theft. Consumers should weigh the pros and cons of each service to determine if it is worth the investment.

How does Aura compare to other identity theft protection services in terms of effectiveness?

According to reviews and ratings, Aura is a highly effective identity theft protection service. Aura offers a range of features, such as credit monitoring, identity theft alerts, and identity restoration services. Consumers should research each service to determine which one best meets their needs.

Can you get effective identity theft protection for free?

While some services offer limited free features such as credit monitoring, most identity theft protection services require a paid subscription for full protection. Consumers should research each service to determine which one best meets their needs and budget.

Between Experian and LifeLock, which offers more comprehensive identity theft protection?

Both Experian and LifeLock offer comprehensive identity theft protection services. Experian offers credit monitoring, identity theft alerts, and identity restoration services. Meanwhile, LifeLock offers similar features, as well as additional features such as dark web monitoring and alerts for unauthorized use of bank accounts and credit cards. Consumers should research each service to determine which one best meets their needs.